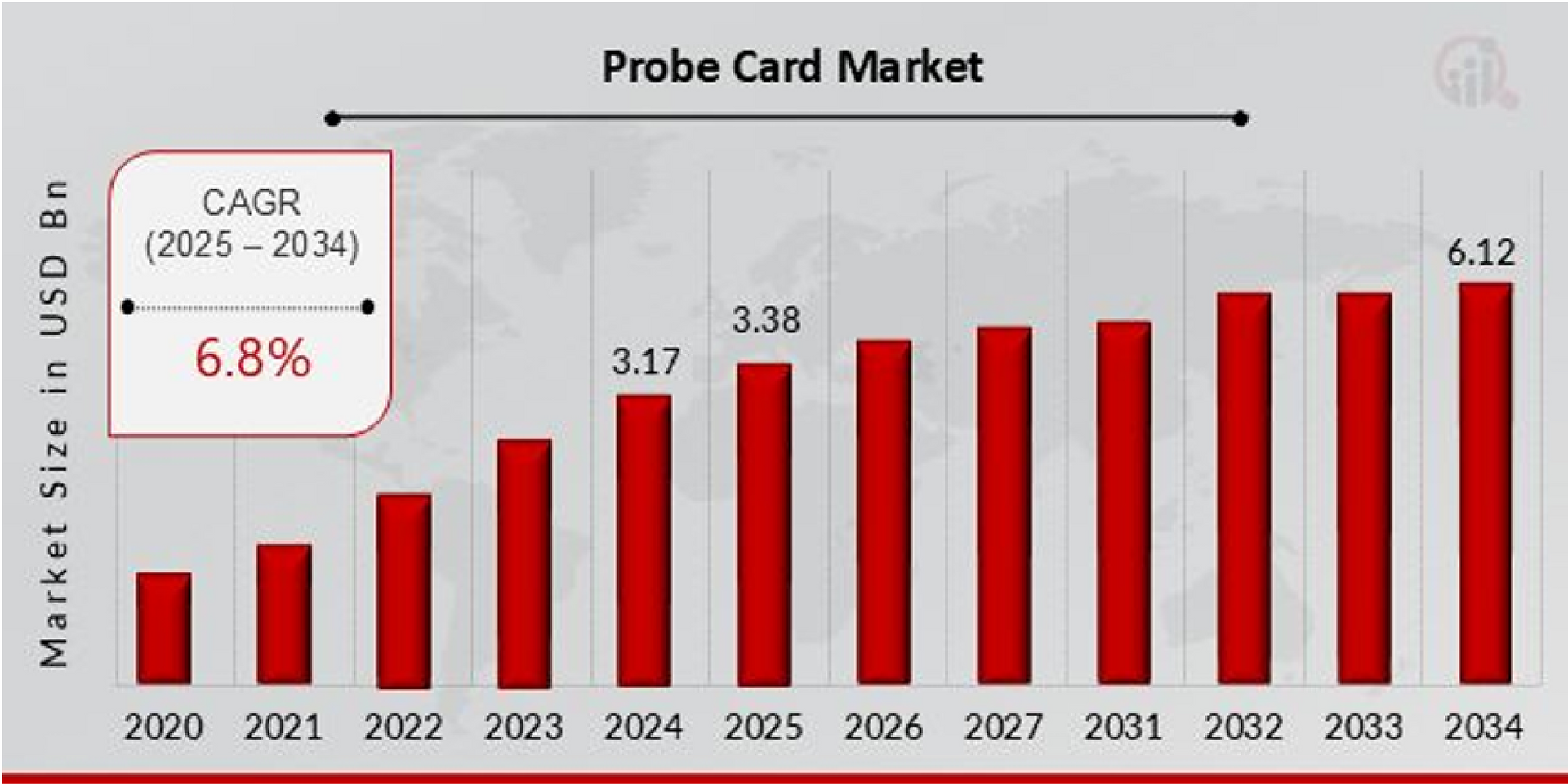

Probe Card Market Opportunity

Probe Card Market Size was valued at USD 3.17 Billion in 2024. The Probe Card market industry is projected to grow from USD 3.38 Billion in 2025 to USD 6.12 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 6.8% during the forecast period (2025 - 2034). Electronics product miniaturization and the increasing use of 3D NAND are the key market drivers accelerating market expansion.

Source

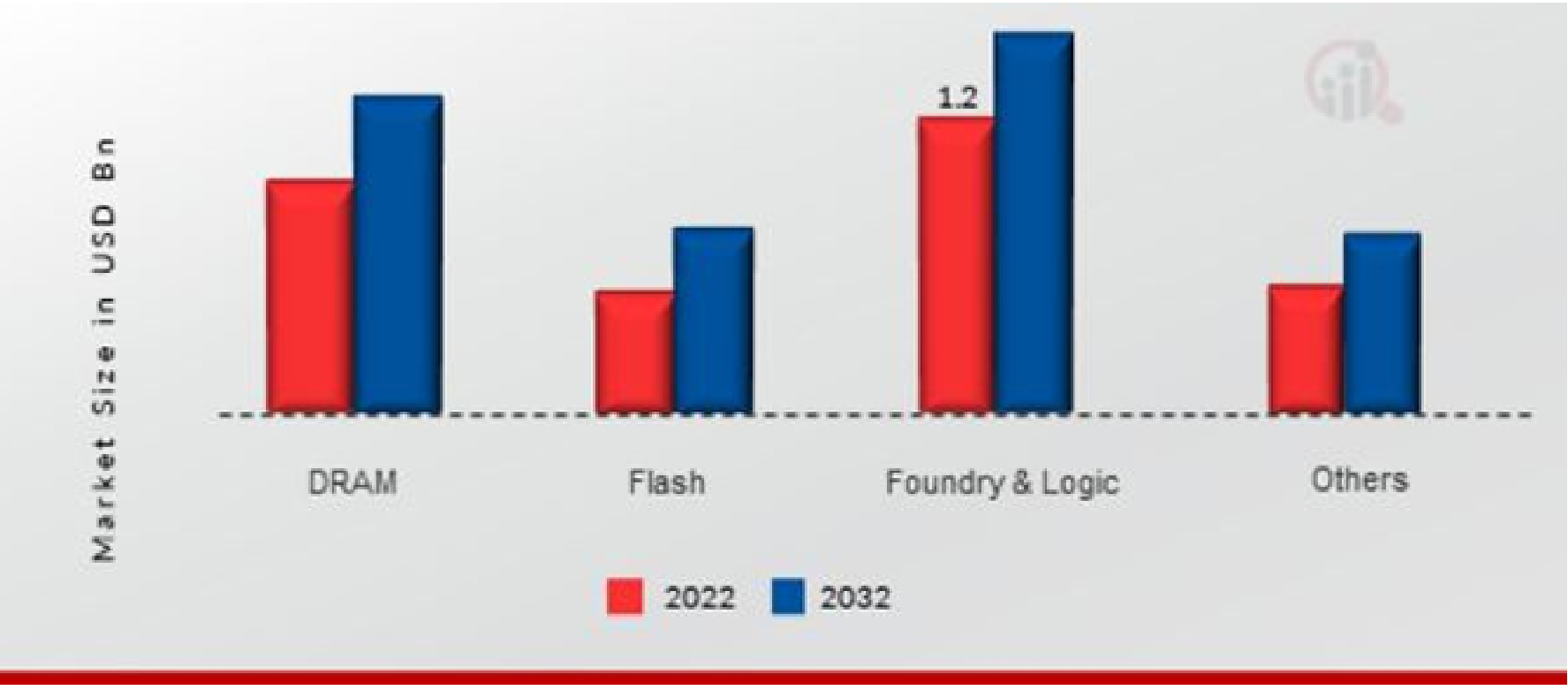

Probe Card Market Segments

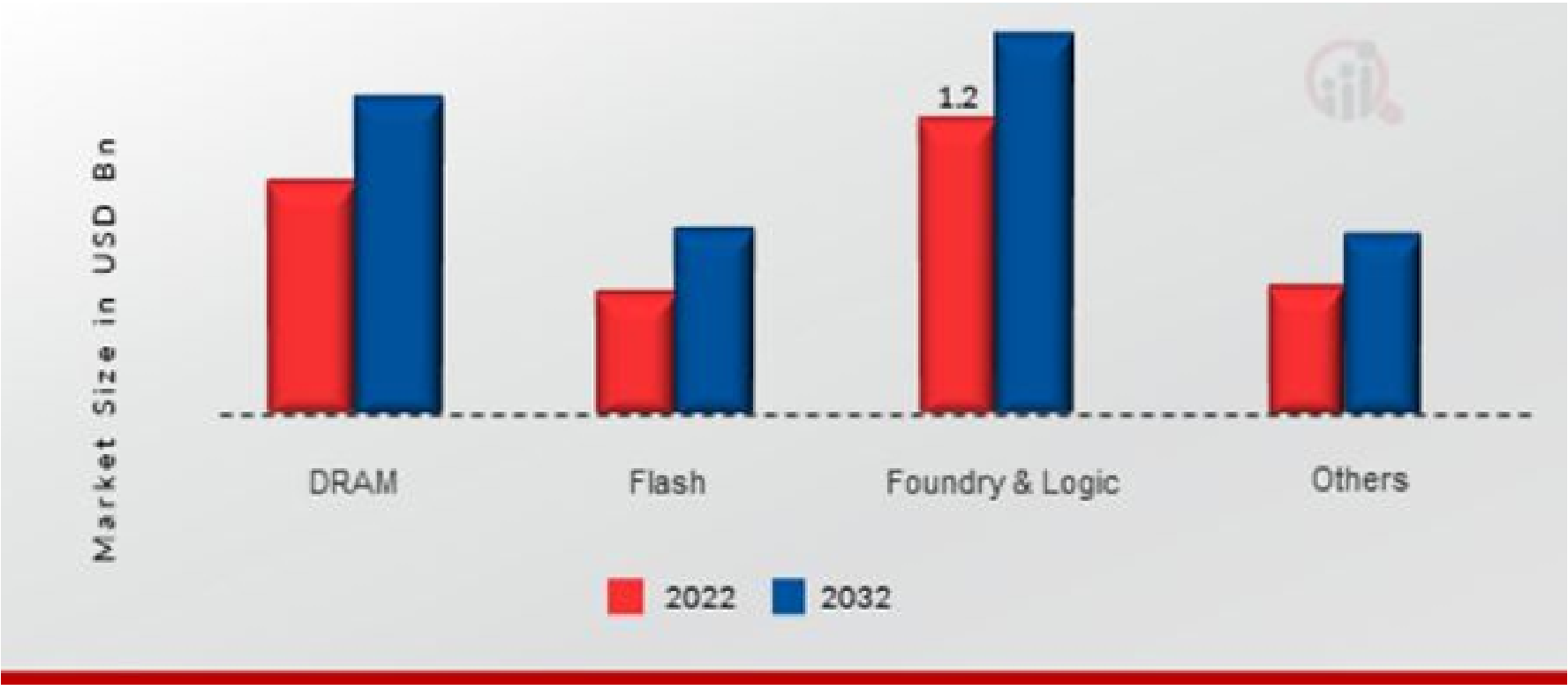

The Probe Card Market segmentation, based on application, includes DRAM, Flash, Foundry & Logic, and Others. The foundry & logic category generated the most income. The foundry model employs two strategies to lower these expenses, whereas enterprises that do not have such facilities save money. Conversely, merchant foundries source their work from a worldwide network of fables companies and maintain plant operations by meticulous contracting, pricing, and scheduling.

Source

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American Probe Card market area will dominate this market, because to growing funding for R&D, the need for specially made semiconductors for electronic gadgets, and advantageous public policies.

Further, the major countries studied in the market report are The US, German, France, the UK, Canada, Italy, Spain, India, Australia, South Korea, China, Japan, and Brazil.

Source

UMPC Solution

| Category | MMPC (Mixed MEMS Probe Card) | UMPC (Unibody MEMS Probe Card) |

|---|---|---|

| Coplanarity & Contact | Requires high overdrive due to uneven contact; risk of solder ball damage | <1um coplanarity with minimal overdrive; superior mechanical |

| Contamination & Cleaning | Frequent cleaning due to solder paste adhesion | No cleaning required for >100,000 test cycles |

| Repair & Maintenance | Manual micron-level adjustments; disassembly required | Rigid unibody design prevents distortion; little to no rework |

| Skilled Labor Dependency | >3,000 hours to train probe repair technicians | Low technician dependency; minimal learning curve |

| Engineer Training Time | >1,200 hours to train application engineers | Simplified setup; streamlined integration with test systems |

| Backup Cards Needed | Up to 12 backup cards needed per line | 1 UMPC replaces 12 MMPCs; lower CAPEX |

| Production Downtime Risk | High downtime risk; unpredictable repair timelines | High reliability; extended MTBF for uninterrupted production |

| Signal Integrity | Long probe length (>6,000 µm) causes inductive losses | Shorter, denser probes optimized for GHz-range signal integrity |

| High-Frequency Suitability | Limited to low/mid-frequency applications | Ideal for AI/CPU/HPC testing with GHz+ capability |

| Cost Efficiency | High cost per test due to cleaning, rework, and spares | Lower TCO; optimized cost-performance ratio |

| Scalability & Automation | Labor-intensive; difficult to scale | Designed for automation and high-volume manufacturing |

Target Market

Serviceable Obtainable Market (SOM) Goal:

- Capture 6% market share

- (~$560M nnual revenue) by Year 5